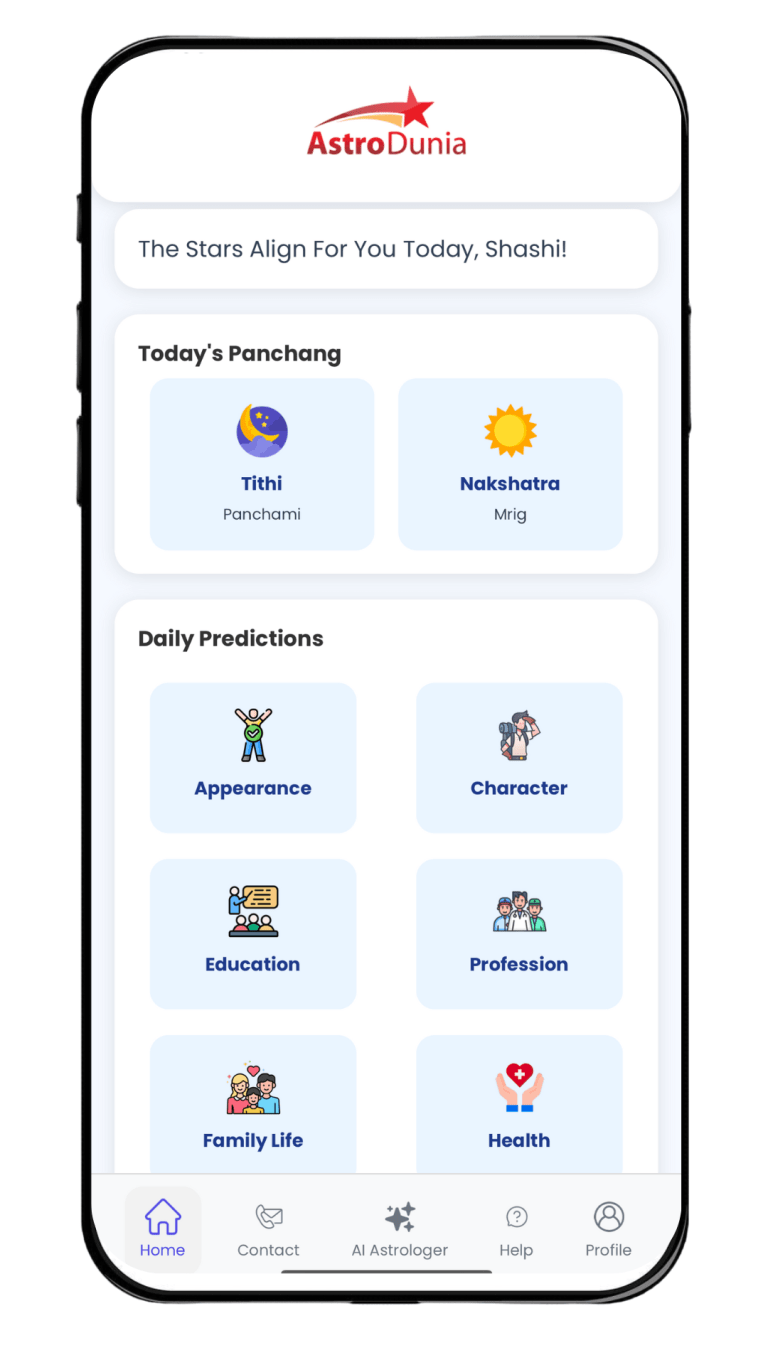

Discover the Secrets of Your Life With Astrodunia Ai

Learn how the planets influence your life with a basic Kundli analysis, absolutely free with Astrodunia Ai . Want more detailed guidance? Upgrade to a full consultation anytime.

Find Your Life Purpose

Personalized Horoscope

Discover the hidden insights of your birth chart. Our in-depth Kundli analysis reveals more about your personality, significant life events, and what the future holds.

Zodiac Predictions

Stay one step ahead with accurate Rashiphal forecasts. Get personalized guidance on career, relationships, and health, based on your zodiac sign.

Trustworthy Advice

Connect with professional astrologers for personalized guidance and practical solutions. Let their expertise help you navigate life’s challenges with confidence.

Annual Letter 2025

Gain valuable perspectives on the past year’s achievements and future opportunities. This annual letter offers a clear vision to help you navigate the financial landscape in 2025.

Market Timing Services

Make smarter investment decisions with our expert market timing guidance. Stay ahead of the curve and confidently seize profitable opportunities.

Finance Calculator

Simplify your financial planning with our user-friendly calculator app. From budgeting to retirement planning, manage your money more effectively.

How Astrodunia can help you ?

Market Timing has proved to be an effective solution for traders and investors alike. The right position at the right time is the perfect recipe.

Research

Our products are a result of intense research and expertise across multiple verticals of astrology and financial markets.

Crisp & Clear Vision

We take pride in providing crisp and clear advise to individuals like you. Unambiguous and distinct vision that helps you stay ahead of the curve.

Extensive Support

Happy to assist you in best possible ways and enhance your experience with one of the oldest science from the Vedic India.

How Astrodunia can help you ?

Market Timing has proved to be an effective solution for traders and investors alike. The right position at the right time is the perfect recipe.

Rajeev Prakash Agarwal

Founder/CEO- Astrologer

Biswaranjan Upadhyaya

Vedic Astrologer

Astrodunia Ai Astrologer

Ai Astrologer

Discover Astrodunia’s Journey So Far

At Astrodunia, we believe that the power of astrology and numerology can help everyone unlock their true potential. Our mission is to provide accurate guidance, expert insights, and accessible tools that inspire clarity and confidence in the lives of our users. With a team of seasoned astrologers and a deep commitment to customer satisfaction, we are dedicated to delivering meaningful, life-enhancing experiences. Join us as we combine tradition with modern solutions to help you overcome challenges and fulfill your greatest aspirations.

What Our Customers Say

Learn what our happy customers have to say about the exceptional quality and value we deliver.

Integrate Market Timing Today